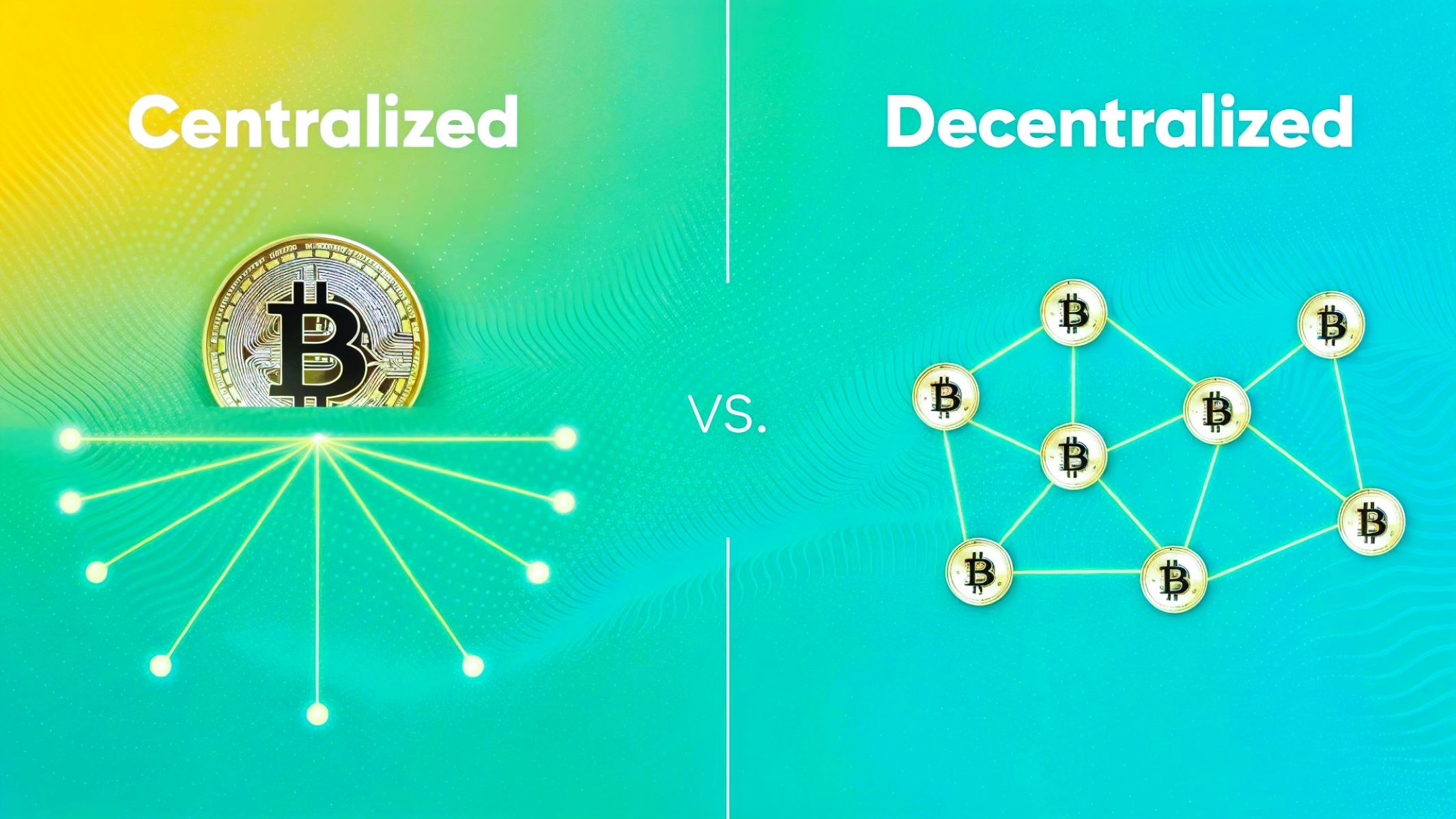

When it comes to trading cryptocurrencies, one of the first things you’ll bump into is the concept of exchanges — but not all exchanges are created equal. The two big players in the game are centralised exchanges (CEXs) and decentralised exchanges (DEXs). Both serve the same basic purpose: letting you buy, sell, or trade cryptocurrencies. But how they do it, who controls them, and how safe they are can be worlds apart. So, what exactly is the difference between centralised and decentralised exchanges? Let’s break it down step-by-step and dig into the details.

What is a Centralised Exchange (CEX)?

A centralised exchange, often abbreviated as CEX, functions much like a traditional stock exchange, but for cryptocurrencies. It is operated by a single company or organisation that acts as the middleman between buyers and sellers. This setup means the exchange takes responsibility for facilitating trades, managing user funds, and maintaining the overall system’s integrity. Because everything is controlled centrally, users rely heavily on the exchange to provide a secure and efficient trading environment.

When you use a centralised exchange, you typically deposit your funds—whether fiat currency like dollars or cryptocurrencies—into the platform’s wallets. The exchange then holds these funds on your behalf, allowing you to trade without directly interacting with other users’ wallets. This model simplifies trading for many people because the exchange handles order matching, price discovery, and execution in real time. However, it also means that users must trust the platform with their money, which brings its own set of risks.

Centralised exchanges are known for their ease of use, making them the go-to choice for beginners entering the crypto space. They offer intuitive interfaces and streamlined processes for buying, selling, and withdrawing assets. Additionally, these platforms usually have high liquidity, meaning there are plenty of buyers and sellers at any given time. This liquidity ensures that large trades can be completed quickly without causing major price fluctuations, which is crucial for active traders and investors alike.

Some of the biggest names in the crypto industry operate as centralised exchanges, such as Binance, Coinbase, and Kraken. These platforms serve millions of users worldwide and process billions of dollars in daily transactions. Their scale allows them to offer features like customer support, advanced security measures, and a wide range of trading pairs. While centralised exchanges provide convenience and speed, their central control also means users must carefully consider security and trust factors before committing their funds.

What is a Decentralised Exchange (DEX)?

| Aspect | Description | How It Works | Popular Examples | Key Benefits |

| Definition | A decentralised exchange (DEX) is a platform that allows users to trade cryptocurrencies directly without an intermediary. It runs on blockchain networks using smart contracts. | Trades happen peer-to-peer, with smart contracts automatically matching buy and sell orders. | Uniswap, SushiSwap, PancakeSwap | No central authority; users keep control of their funds at all times. |

| Control & Custody | Users maintain full control of their assets since there is no central entity holding funds. | Transactions are executed directly from users’ wallets via blockchain. | Greater privacy, often no KYC needed, enhancing anonymity. | |

| Security | Because there is no central wallet storing all funds, the risk of large-scale hacks is reduced. | Blockchain ensures transparency and immutability of transactions. | Reduced risk of hacks and theft due to decentralised custody. | |

| Transparency & Accessibility | Most DEX platforms are open-source, allowing anyone to audit and verify their code. | Open-source code is publicly available on blockchain explorers and GitHub. | Open access fosters trust and innovation in the ecosystem. | |

| Popular Use Cases | Especially popular in the DeFi (decentralised finance) sector, enabling token swaps, yield farming, and liquidity pools. | Users can provide liquidity, earn fees, and participate in various DeFi activities. | Enables financial services without traditional intermediaries. |

Centralised vs Decentralised: The Main Differences

- Control

Centralised exchanges are controlled by a single company or organisation. This means they make the decisions, manage the platform, and oversee all operations. In contrast, decentralised exchanges put control directly in the hands of the users. You keep full ownership of your funds and decisions, without relying on any middleman. - Custody

On a centralised exchange, the platform holds your funds for you. When you deposit money or crypto, it’s stored in the exchange’s wallets until you trade or withdraw. On a decentralised exchange, however, you retain custody of your assets at all times. Trades happen directly from your personal wallet, eliminating the need to trust a third party with your funds. - Liquidity

Centralised exchanges typically have very high liquidity because they have large numbers of users and deep order books. This means you can buy or sell big amounts quickly without causing significant price changes. Decentralised exchanges often have lower liquidity, especially for less popular tokens, which can lead to bigger price swings and slower trade execution. - Security

Centralised exchanges are vulnerable to hacks, especially because they hold large amounts of users’ funds in centralized wallets. If those wallets are compromised, many users can be affected. Decentralised exchanges are generally considered more secure because users keep their funds, and there is no single point of failure. However, DEXs are not without risks — smart contracts can have vulnerabilities, and bugs might lead to loss of funds. - User Experience

Centralised exchanges offer an easy-to-use interface, fast trade execution, and often responsive customer support. This makes them popular for beginners and casual traders. On the other hand, decentralised exchanges can sometimes be more complex, requiring users to understand wallets, private keys, and gas fees. Transactions on DEXs can also be slower depending on blockchain congestion. - Privacy

Most centralised exchanges require users to complete KYC (Know Your Customer) verification, which means submitting personal information like ID documents. This is due to regulatory requirements. Decentralised exchanges usually do not require KYC, allowing users to trade with greater privacy and anonymity since there is no central entity collecting personal data. - Trading Pairs

Centralised exchanges support a wide range of trading pairs, including fiat-to-crypto pairs, allowing users to deposit and withdraw traditional currencies. Decentralised exchanges mostly focus on crypto-to-crypto trading, meaning you swap one cryptocurrency for another without involving fiat currencies. - Fees

Centralised exchanges typically charge trading fees and may also charge withdrawal fees when you move funds out of the platform. Decentralised exchanges often have lower or no trading fees charged by the platform itself but require users to pay blockchain network fees, commonly known as gas fees, which can fluctuate based on network demand.

Why Would You Choose a Centralised Exchange?

If you’re just starting out with cryptocurrency or you want a straightforward, hassle-free way to trade, centralised exchanges are usually the easiest option to go for. These platforms are designed with the user experience in mind, offering simple interfaces that make buying, selling, and managing crypto feel as familiar as online shopping. For beginners, this means you don’t have to worry about complex blockchain mechanics or managing private keys yourself — the exchange takes care of much of the heavy lifting.

One of the biggest perks of using a centralised exchange is speed. Since all trades happen within the exchange’s own system, you don’t have to wait for slow blockchain confirmations to complete every transaction. This instant processing lets you take advantage of market movements quickly, which is especially important if you’re trading actively or trying to capitalize on short-term opportunities. The ability to execute trades fast can make a huge difference when the market is volatile.

Another major advantage is the availability of fiat onramps. Centralised exchanges allow you to deposit traditional money like dollars, euros, or rupees directly into your account, which you can then use to buy cryptocurrencies. This seamless conversion between fiat and crypto makes it much easier for people to enter the market without needing to understand complicated peer-to-peer swaps or third-party services. Plus, when you want to cash out, you can convert your crypto back to fiat and withdraw it to your bank account.

Finally, having customer support is a comfort many users appreciate. If you ever run into problems — maybe a withdrawal delay or a technical issue — centralised exchanges usually have teams ready to help you out. It’s like walking into a physical store with a cashier who can answer your questions and assist you whenever needed. This human element can give new users confidence and peace of mind as they navigate the sometimes intimidating world of cryptocurrency trading.

Why Would You Opt for a Decentralised Exchange?

| Aspect | Description | Benefit | User Impact | Example |

| Control Over Funds | Users hold their own private keys and funds without handing them to any third party. | Full ownership and control of assets. | Eliminates risk of losing funds due to exchange failure. | You act as your own bank. |

| Privacy | No need to provide personal information or complete KYC verification. | Enhanced privacy and anonymity. | Users can trade without revealing identity. | Trade without sharing data. |

| Transparency | All transactions and trades are recorded on the blockchain, accessible to anyone. | Complete openness and auditability. | Builds trust through public verification of activity. | On-chain records for all. |

| Permissionless Trading | Anyone can list tokens or trade without needing approval from a central authority. | More freedom and access to diverse tokens. | Encourages innovation and access to new assets. | List any token you want. |

| Decentralised Market | Operates without a middleman or central authority, relying on smart contracts for trades. | No central point of failure or censorship. | Users have full control over their trading experience. | Self-service marketplace. |

How Security Compares

- Centralised exchanges are common targets for hackers because they hold large amounts of user funds in hot wallets connected to the internet, making them vulnerable to cyber attacks.

- When a centralised exchange gets hacked, users risk losing their assets since these platforms store many funds in one place, creating a single point of failure.

- Internal fraud is another concern for centralised exchanges; since a company or organisation controls the platform, there is a risk that insiders may misuse or steal funds.

- Regulatory authorities have the power to freeze or seize assets held on centralised exchanges, meaning users might lose access to their money due to legal or compliance issues.

- Because centralised exchanges handle all custody of funds, users must trust the platform’s security measures and internal controls to protect their assets.

- Centralised exchanges often invest heavily in security infrastructure, insurance policies, and compliance to mitigate risks, but no system is entirely foolproof.

- Decentralised exchanges operate using smart contracts, which are pieces of code that automatically execute trades, but these contracts can contain bugs or vulnerabilities that hackers may exploit.

- Smart contract flaws can lead to severe losses, including drained funds, manipulated trades, or denial-of-service attacks that disrupt trading activities.

- On a decentralised exchange, users fully control their wallets and private keys, which means they alone are responsible for securing access to their funds.

- Losing private keys or making mistakes in managing wallets on a DEX means losing access to funds permanently, with no customer support to help recover them.

- Decentralised exchanges don’t hold user funds centrally, so they avoid the risk of mass hacks targeting a single wallet, but individual security depends on user behavior.

- Liquidity on decentralised exchanges is often lower than on centralised platforms, which can cause slippage during trades and make it harder to execute large orders without losses.